Raymond Chabot Grant Thornton is proud to count in its ranks a new recipient of the prestigious title Fellow (FCPA) of the Ordre des comptables professionnels agréés du Québec.

Mario Morin serves as Vice-President of the Québec City and Regional Urban Centres region. In this capacity, he plays a highly strategic role where his talents of a seasoned unifier, visionary and manager shine through.

Since he began at Raymond Chabot Grant Thornton in 1989, Mario has always given his utmost to provide quality services and strive for excellence, which has enabled him to build performing, passionate and dedicated teams focused on client service. He believes in the importance of transparency, collaboration, knowledge-sharing and collective intelligence. This recognition is a testament to his great leadership and exemplary professionalism.

Beyond his illustrious professional career, Mario has volunteered in numerous initiatives and contributed to the development of communities and those involved.

Mario also stands out through his qualities as an inspiring leader, using his expertise and commitment to make of this region and its talent a distinctive community: it’s no surprise that he has received this hallmark award.

Following Paul Bérubé, Edmundston office Partner, who was named a Fellow last January, Mario joins the ranks of the twenty or so of our Fellow Partners. This is truly a proud moment for Raymond Chabot Grant Thornton!

26 Feb 2019 | Written by :

Mario Morin is an assurance expert at Raymond Chabot Grant Thornton. Contact him today.

See the profileYou could also like to read

Next article

Bookkeeping is both a legal obligation and a fundamental management tool which can prove to be a complex task for some entrepreneurs.

Oftentimes, bookkeeping may be neglected due to a lack of time or internal resources or simply because accounting standards are difficult to grasp.

What exactly is bookkeeping?

- Accounting for current transactions;

- Filing government reports;

- Reconciling accounts.

Several deadlines must be met, for example to file tax forms, deductions at source and commodity tax reports.

A healthy business requires an organized and accurate bookkeeping system.

By working with our bookkeeping experts, you can:

- Obtain an overview of your business’s financial results;

- Avoid late filing penalties with respect to deductions at source and remittances;

- Avoid uncertainty and the resulting errors;

- Save time when preparing your financial statements;

- Closely monitor your business’s financial health;

- Take advantage of all the credits you are entitled to;

- Offset a staff shortage.

Our goal is to advise you and support your business’s growth. You can trust our experts to provide rigorous and efficient bookkeeping assistance.

Next article

Does your business perform manufacturing and processing activities? Are you considering acquiring production equipment or computer systems for your processes, particularly as part of your 4.0 manufacturing strategy? You should do it in 2019.

The Quebec investment tax credit (QITC) for manufacturing and processing equipment has been enhanced and is now available for ALL Quebec regions with some very attractive benefits.

The temporary increase in the QITC announced by the Quebec government on August 15, 2018 (increase applicable to property acquired after August 15, 2018 and before January 1, 2020) is designed to support the expansion and productivity improvements of businesses investing in manufacturing and processing equipment.

QITC tax rate

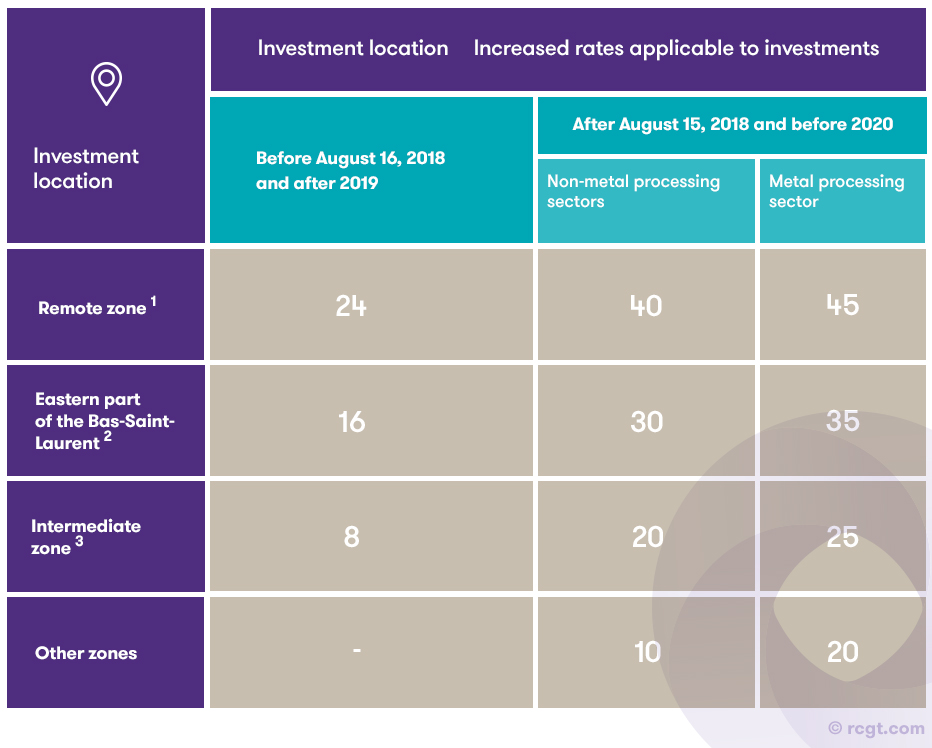

The QITC tax rate is at least 10% (20% for the metal processing sector) and can be as much as 45% for some Quebec regions (provided the corporation is entitled to the increased rates, otherwise it would be 5%) (see the table below).

The applicable credit rate depends on the location and timing of the investment as well as other factors:

- The size of the business (global paid-up capital);

- Whether the corporation qualifies as a metal processing corporation (based on the overall payroll);

- Eligible property (is new and used exclusively in Quebec):

- Internally designed and manufactured equipment for the business’s own use may qualify;

- Eligible related expenditures;

- Optimizing eligible expenditures ($12,500 exclusion threshold per property).

While it may be advantageous, the QITC is a complex tax measure that is closely scrutinized by Revenu Québec.

Our canadian tax experts can support your processes in order to maximize the QITC during the preliminary analysis, optimization, documentation and filing of the application, assisting during the audit and much more…

Not only can they help you achieve savings by ensuring you have everything you need to claim the credit, they would be more than pleased to advise you on the additional capital cost allowance, accelerated capital cost allowance and any other matter to help reduce your tax burden. Contact us.

The following table presents the QITC for businesses with a paid-up capital under $250 million.

- The remote zones consist of the following administrative regions: Abitibi-Témiscamingue, Côte-Nord, Nord-du-Québec and Gaspésie–Îles-de-la-Madeleine.

- The eastern portion of the Bas-Saint-administrative regions includes the following Regional County Municipalities (RCM): La Matapédia, La Mitis and La Matanie.

- The intermediate zones include the following administrative regions and RCMs: Saguenay–Lac-Saint-Jean administrative region, Mauricie administrative region, Antoine-Labelle RCM, Kamouraska RCM, La Vallée-de-la-Gatineau RCM, Les Basques RCM, Pontiac RCM, Rimouski-Neigette RCM, Rivière-du-Loup RCM and Témiscouata RCM.

This article was written in collaboration with Kim Joyal Lamarche.

26 Feb 2019 | Written by :

Pascal Leclerc is a tax expert at Raymond Chabot Grant Thonrton. Contact him today!

See the profileNext article

The inescapable workforce shortage issue requires organizations to reinvent themselves. Increasingly, they are introducing initiatives to attract and retain employees.

The Raymond Chabot Grant Thornton Saguenay–Lac-Saint-Jean Partners had a bold and original idea to offer a trip to New York City to some 100 employees on February 1-3, 2019.

Éric Dufour, Regional Vice-President stated: “We practise what we preach! We support organizations in deploying strategic human resource activities. We have to adapt as well and ensure that our employees have a high happiness and engagement index.”

The New York trip was the culmination of an ongoing improvement initiative involving employees during 2018.

Claudie Arcand-Bellemare, Tax Consultant said: “It was awesome. It’s a privilege to work for an employer of choice who gives us the opportunity to have exceptional experiences and strengthen the bonds with our colleagues. Everybody came back from the trip more motivated than ever.”

In addition to the reward, new measures were introduced recently to meet the needs of the new generations, such as flexible schedules, a new dress code and a new governance structure.